- Business Partner LoginLogin as a Business Partner to

manage installment plans and view

transaction histories. - Customer Account LoginLog in to view your installments plan,

track payments, and access your

account details.

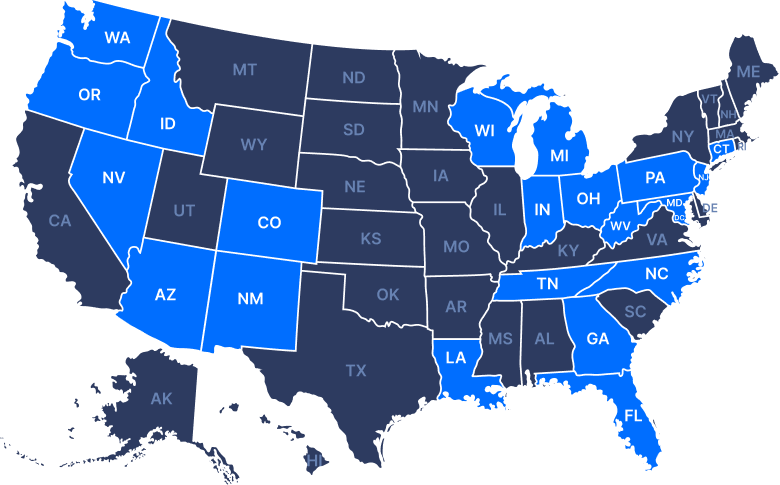

PATH: Installment Financing

Vehicle Acquisition

Secure financing to purchase new or used vehicles that meet your business needs.

Refinancing Options

Lower monthly payments or reduce interest rates by refinancing existing loans.

Fleet Expansion

Scale your operations with funding for multiple vehicles or specialized equipment.

Flexible Repayment Terms

Choose loan durations that fit your cash flow, ranging from 36 to 72 months.

Business Vehicle Purchase

Empower your business with the vehicles it needs. Whether you’re expanding a fleet or replacing outdated vehicles, Truvion provides competitive rates and terms to make your purchase affordable.

Lease Buyout

Take ownership of leased vehicles with flexible financing tailored to your needs. Avoid extra fees and keep vehicles that work for your business while saving money with competitive rates.

Commercial Vehicle Refinancing

Free up cash flow by refinancing existing vehicles at better rates. Lower monthly payments, reduce interest rates, and unlock capital for other critical business needs.

Save Monthly

Choose a repayment plan that lowers monthly costs, freeing up cash flow.

Reduce Interest Costs

Secure a better interest rate and reduce your overall loan expense.

Reinvest Savings

Redirect savings into other important areas like hiring, equipment, or marketing.

Reach Out to Us

Get Pre-Qualified

Choose Your Terms

Finalize Your Loan